How Better Payments Reporting Leads to Smarter Business Decisions

Posted on By Glenn Campbell

Reporting is a key pillar for business success, regardless of industry.

In the payments space, reporting is particularly important for decision making – especially when payments are being made in unattended or self-service environments. Clear and comprehensive reports give merchants and their partners the opportunity to analyze all types of transaction data, which in turn enables them to make critical strategic and operational decisions faster and easier.

Better Payments Reporting, Better Insights

The right reporting functionality in your payment solution provides essential insights into key business operations, such as the effectiveness of different channels, the popularity of different payment methods, and even busiest hours of operation. However, while merchants and their vendors both value payments reporting, they use it for different reasons.

Merchants Use Reporting to Drive Business Moves

Whether they’re assessing which locations are underperforming, comparing sales volumes or determining which payment strategies are best suited for individual demographic areas, merchants leverage payments reports for a multitude of reasons. Insights from transaction data can help determine marketing strategy, operational decisions and even expansion options.

Robust reports also ensure merchants can track progress related to corporate KPIs. For instance, a laundromat merchant with multiple locations may use payments data to determine which times of day are slowest by location. They can then use that data to create targeted offerings or promotions to attract more customers during those times. Instead of discounting prices everywhere, they now have the insight to focus on locations that are underperforming.

Software Vendors Use Reporting to Anticipate Needs

ISVs also use payments reporting to track progress on KPIs, but with a slightly broader brush.

Payment processing partners can use the same transactional data to calculate residuals and reconcile with their own records. They can forecast monthly sales and profits, and they can also keep an eye on merchants who might be struggling with operations.

To carry through our example above, if an ISV wants to make sure their laundromat client is satisfied with their payment portal or device, the ISV can monitor the merchant’s transactions to help their technical and customer service teams anticipate requests for assistance.

Both Merchants and ISVs Prefer Consolidated Reports

Of course, reporting is most effective when it combines data across devices, payment types, transaction types, etc. The last thing a merchant or vendor should have to do is pull payment processing data from multiple systems to find out how well one location or device is working. In today’s busy business world, there’s simply no time or patience for that.

Payroc’s unique omnichannel focus makes it easy to see payments processing data across all variables, from device type to location to payment method, creating an essential value proposition for any ISV solution. Even better, ISVs have the option to white label our payment reports so merchants only see one logo and interface.

When it comes to the types of reporting an ISV should offer, the answer is “all of them.” Let’s explore some standard payments reports and how these reports can drive important business decisions.

3 Impactful Payments Reports

Your reporting strategy should start with the basics: real-time insights.

Open Batch Reports Offer Real-Time Insights

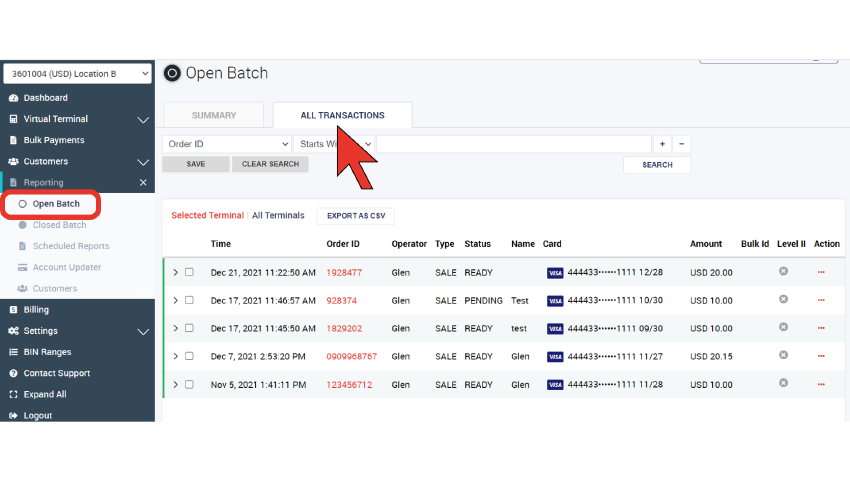

An open batch report pulls data on all the transactions performed that day.

Make Transaction Adjustments

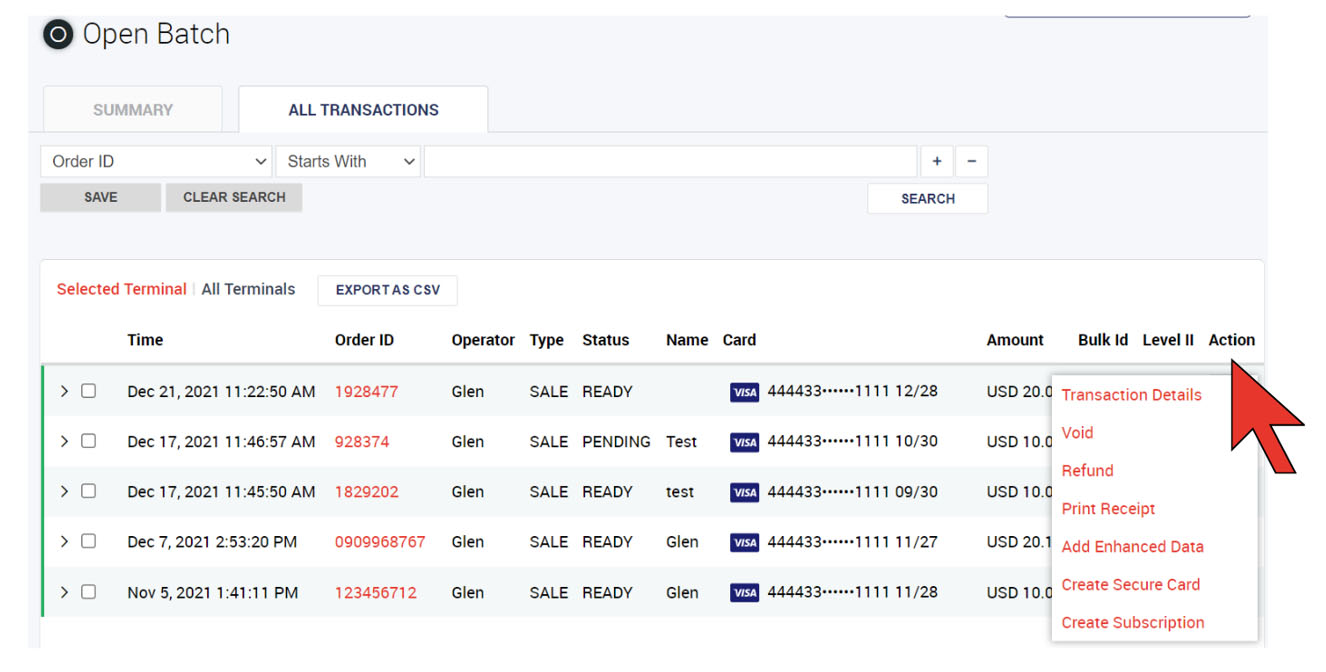

Merchants can use open batch reports to quickly find specific transactions to perform voids, refunds, and receipt reprints. Merchants can also look at transaction details and create a secure card that is stored for later use or a subscription for a customer.

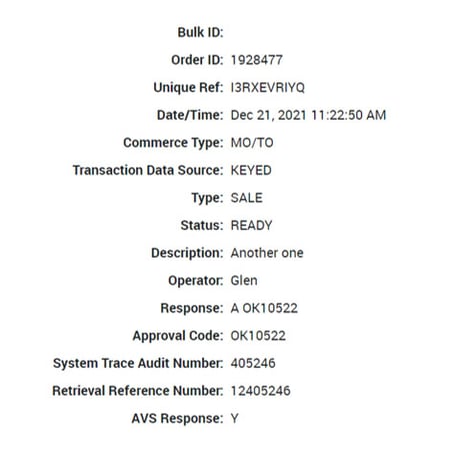

Selecting Transaction Details will show the following information:

Monitor Business Activity

Open batch reports also help merchants keep track of daily activity. For instance, a merchant with multiple car wash locations in multiple regions needs to prioritize resources. Deciding whether a regional manager or a technician should visit a location depends on how well the location is operating. It doesn’t make sense for both resources to travel to every location every day.

Using open batch reports, a merchant can see how business is flowing based on transactions that day. If a normally busy location is reporting an unusually low number of transactions, the merchant instantly knows something is wrong. Armed with this insight, the merchant can now troubleshoot the problem.

Merchants can also use this information to assess hours of operation. If the time of the first transaction is repeatedly two hours past the time a location opens, the merchant might want to change their business hours. Or the merchant might decide to run time-specific promotions designed to bring in customers during normally slow hours.

Over time, this insight can help the merchant optimize all sorts of decisions around marketing, operations, and inventory management.

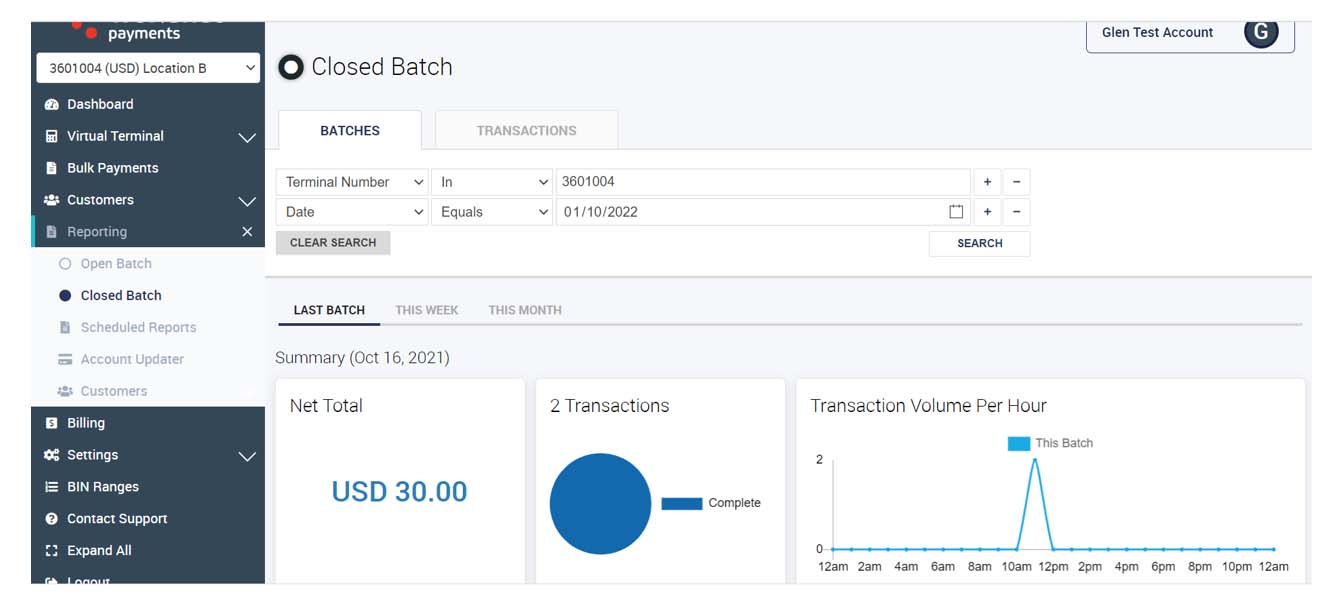

Closed Batch Reports Provide Big Picture Insights

Closed batch reports provide a view of transactions over time, such as for the previous quarter or month. Merchants can search for a specific transaction by order ID, unique reference number, date, credit card number, or any of the other fields in the Self Care system.

Like open batch reports, closed batch reports can be used to process refunds, reprint receipts, and the other functions available in open batch reports. These reports can also reveal broader patterns across a merchant’s business, in specific locations, or even on specific terminals within an individual location.

Using batch reports, merchants can make decisions about hours of operation, terminal expansion, marketing and promotional offers, and the overall health of their operations.

Custom Reports Answer Specific Business Questions

One of the best features of Worldnet Payments’ gateway reporting is the versatility that custom payment reports can provide to merchants, enabling stakeholders to gain insights into nearly any specific business question they might need to answer. Let’s walk through a few examples.

Which Payment Types Are Most Cost-Effective?

A major payments issue merchants must manage is the fees they pay for credit card processing. A merchant that accepts Mastercard or American Express, for example, may find it’s costing them too much in per-transaction fees.

With an omnichannel payment gateway like Worldnet Payments, merchants can customize reporting across all credit card types and even all payment types to make key decisions about payment methods and credit card choices.

For example, a laundromat located in an up-and-coming neighborhood with mostly millennial and Gen Z customers may want to test whether it makes sense to accept mobile payments. Using a custom report, the merchant can compare digital wallet versus credit card transactions to predict if this new strategy will succeed.

Which Devices Work Best in a Specific Location?

Choosing the best device for each payment location can be a challenge. This is why we work closely with ISVs to help them select the best devices for their merchants, depending on function, payment methods, and even aesthetics.

Custom reporting provides the ISV and the merchant with data to back up those device selections.

Back to our laundromat example, the merchant may place both ID TECH and Ingenico devices in the same location – one at the checkout counter and the others on machines themselves. The merchant can then create a custom report to monitor how well both device types are performing, as well as which payment methods are most popular on each device.

This type of data may help the merchant determine if the devices are placed correctly. If they’ve labeled their devices by position within the laundromat (e.g., “Back Corner,” “Checkout,” “Machine 6”), a custom report can provide insight into utilization by time of day, or whether a promotional offer makes a difference.

Which Merchants Need Technical Support?

Payments service partners may send out many devices daily – more than they can check on individually. But it’s important for the vendor to make sure their merchants have each device up and running properly.

Again, custom reports can help. For instance, An ISV can create reports that monitor a merchant’s transactions by device or by location on go-live day. If a device or location shows no transactions within a certain timeframe, the report can flag this issue so the ISV can troubleshoot and follow up with the merchant. This allows the vendor to deliver excellent customer support and the merchant to receive the timely assistance they need.

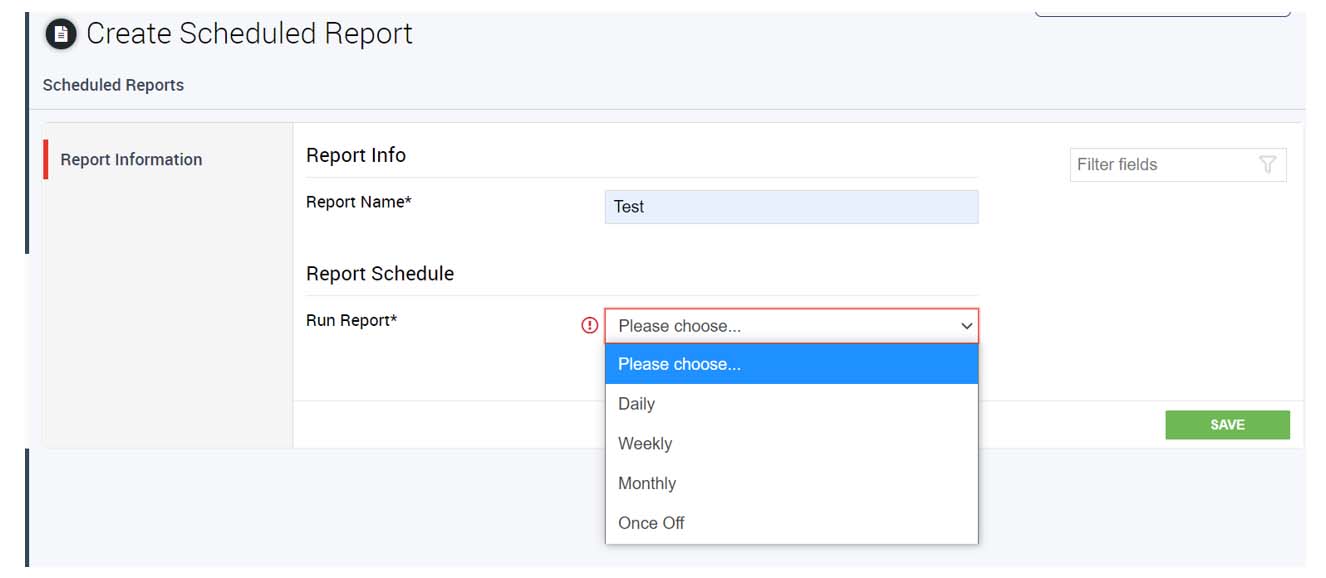

Scheduled Reporting Ensures Consistency

Scheduling custom reports can deliver even more impact on a daily, weekly, or monthly basis. Scheduled reports can also be downloaded as a .csv file and imported into other software tools, such as a fraud prevention software solution for further extrapolation and processing.

With Worldnet Payments reporting, stakeholders have access to a broad range of historical data and can have reports optionally emailed to a sole recipient, a group of people, or a server for company-wide access.

Complete Range of Reporting Options

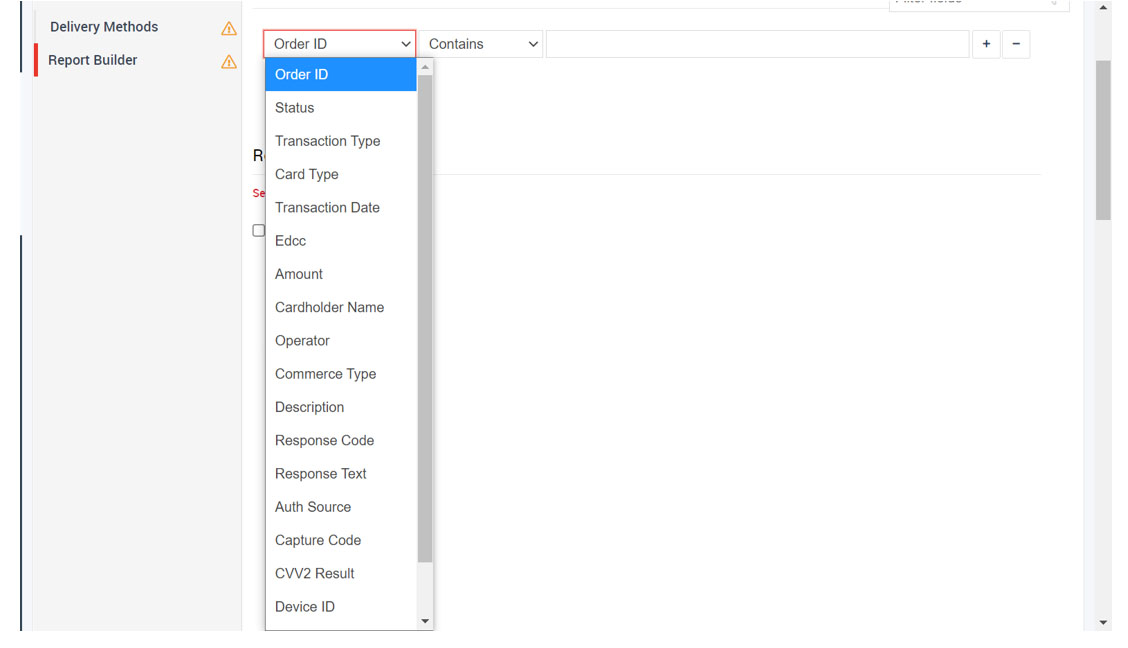

Wordnet Payments reporting enables users to select from a range of criteria to build various reports and see all charges—across different payment types, countries, currencies, terminals, and much more.

Payment Reports Available: choose from any of these reporting fields

| Order ID Status Currency Amount Card Type Card Number Card Expiry Cardholder Name Cardholder Email Operator Commerce Type Description Response Code Response Text Auth. Source Capture Code AVS Response CVV2 Result PreAuth Status Terminal Type Device Name |

Card Read Method Max Mind Risk Score Fraud Status Issuer Response Code Secure Card merchant Reference Subscription Merchant Reference Tax Tip Amount 3DS Phone Country City Region IP Address Custom Fields Unique Ref Transaction Date Approval Code RRN |

STAN Cardholder Currency Terminal Number Edcc Credit/Debit Transaction Type Merchant ID Merchant Name Batch Date Acquirer Customer First Name Customer Last Name Customer Device Name Level Card Data Cardholder Amount Cardholder Rate PreAuth Reference Number Mobile Number Surcharge Bank Terminal ID Bank Merchant ID |

The Best Payments Reporting Depends on the Right Payment Gateway Partner

Reporting is a critical component of tracking KPIs and measuring ROI for any business – but particularly merchants. At Payroc, we offer sophisticated payments reporting capabilities that combine standard and customizable views of virtually any data element. If desired, ISVs can white-label our reports to integrate seamlessly into their own payment solutions.

If you’re interested in exploring how to integrate sophisticated reporting into your merchant solution, or need help with any reporting questions, contact one of our specialists today.