Credit card processing fees are the worst. However, you have to pay them if you want to process credit cards through your business.

You never want to give money blindly. So, you should make an effort to understand the fees you are paying.

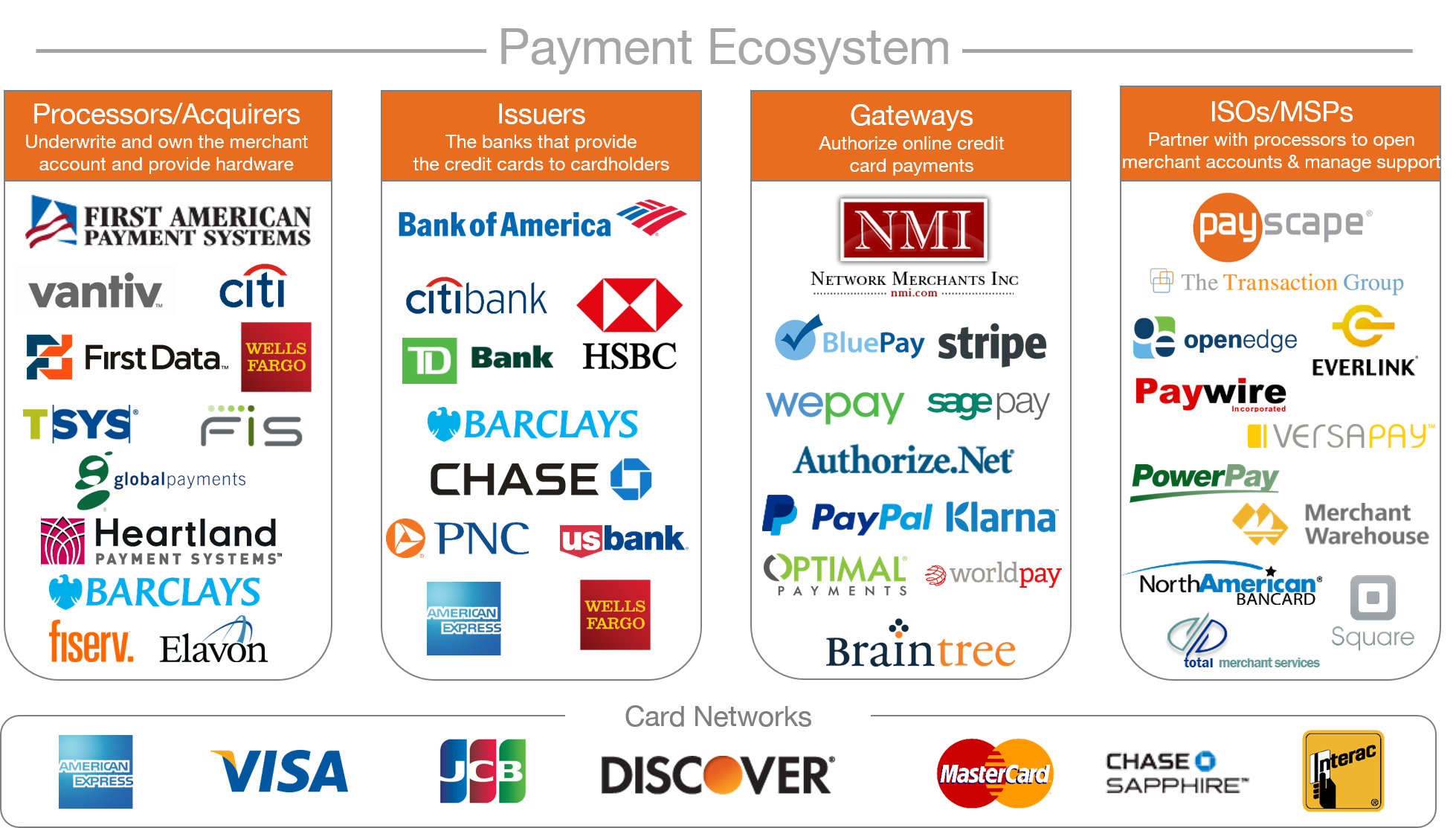

The first thing that should be understood are the five parties involved:

- Credit Card Networks: the companies that create the credit cards

- Issuers: the institutions that issue the credit cards (i.e. Wells Fargo, Suntrust)

- Processors/Acquirers: messengers between merchants and credit card associations

- Merchant Service Providers (ISO's): PAYSCAPE! The companies that manage credit card processing (i.e. sales, support)

- Payment Gateways: Special portals that route transactions to an acquiring bank.

There are two types of fees, wholesale fees and markups.

- Wholesale Fees: They are determined by the credit card issuing bank and the credit card associations (MasterCard, Visa, etc.),and they are non-negotiable.

- Markups: This is how your credit card processor is planning to make a profit for your business. Having the right processor is important or you could be in trouble! Payscape has modest fees, uses terms you understand and a pricing model that would look reasonable to anyone.

There are different pricing models which explain how a credit card processor will charge you for you wholesale and markup fees.

Interchange Plus Pricing Model

This pricing model itemizes your wholesale fees and markup fees, then they are listed on your monthly statement. This is the most understandable pricing model because the terms and fees are easy to understand.

Tiered

This plan is what a majority of business owners are on. Tiered pricing plans categorize credit card transactions into three different categories:

- Qualified

- Mid-Qualified

- Non-Qualified

Qualified rates are the lowest and they increase from there. In order to be qualified, the transactions must meet all of the processor's criteria including the swipe.

Subscription/Membership

The subscription/membership model is similar to the interchange-plus model. They both charge the mark up separately from the actual cost of the transaction. However, with subscription/membership, you do not pay a percentage markup. You pay a small transaction fee.

There are more pricing plans available. Payscape offers very aggressive and competitive pricing plans.

- Tiered

- Enhanced Interchange

- Flat Rate

- Consolidate

The last part is the breakdown of fees. There are different fees that will show up on your monthly statement.

- Transnational Fees

- Terminal Fees

- Payment Gateway Fees

- Annual Fees

- Early Termination Fees

- Payment Card Industry Fees

- Monthly Fees

- Statement Fees

- Network Fees

- Etc.

Every merchant service provider is different. Some may include all the fees and some may not. It all depends on what you are using. For example Payscape has many options and combinations.

In the end, understand what you are paying for with these merchant services. Payment gateway services are now a necessary part of the business environment. Be sure to check out our Small Business Guide to Credit Card Processing for more tips on how to protect yourself from being overcharged.