As the merchant, the most important thing to you is the swipe and approval. Explaining why a credit card got declined is not in your list of expertise. That is what the customer service number is for on the back of the credit card.

There are three things every merchant should know about for payment processing.

- Authorization

- Settlement

- Funding

Authorization is key. Without it, you will not be able to accept your customer's credit card for payment, which could mean a loss in sales. Authorization can be obtained through a credit card machine, e-commerce web site or over the phone.

Authorization happens in 8 easy steps

- Your customer presents their credit card to make a purchase.

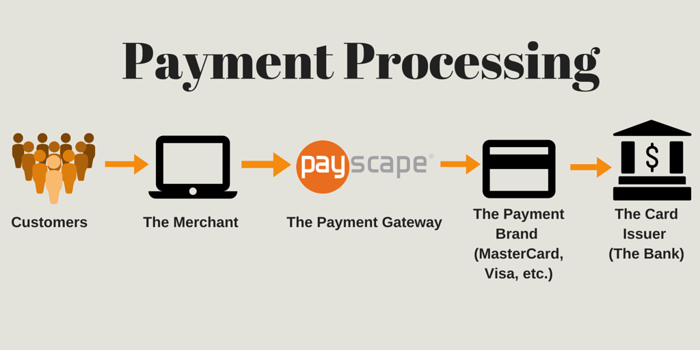

- You, the merchant, transmit the credit card information to the Payscape gateway. This means, you swipe the card and enter the dollar amount which then sends the information to Payscape.

- The Payscape Gateway then forwards your request to the card payment branch, which is MasterCard, Visa, etc.

- The payment brand will then send your request to the card issuer, which is the bank that issued the card to the customer.

- The card issuer will approve or decline the transaction, and then send a response to the payment brand.

- The payment brand will then send a response to the Payscape gateway.

- The Payscape gateway will then forward the response to you, either via your Payscape credit card terminal, your e-commerce website or verbally over the phone.

- The card will either be approved, declined or referred.

Approval means the payment was accepted.

Declined means the card cannot be used to complete the transaction.

Referred means a request for additional information will be asked, either from the merchant or the cardholder, before an approval can be issued.

Settlement must now take place. Just because your customer considers the sale complete, does not mean it is complete for you.

How it works:

- You, the merchant, will submit your transaction information to Payscape. For this, you use your Payscape credit card terminal to trigger, or "batch", a settlement.

- Payscape then forwards your settlement request to the appropriate payment brand for confirmation with the cardholder's issuing bank.

- When the payment brand receives the request, they will issue a credit to Payscape so we can reimburse you for the amount of the settled transaction and they will issue debt to the customer to charge them for the transaction.

- The issuer will then post the transaction to the customer's account.

- The customer will then pay their bill when they receive their credit card statement, which goes to the card issuer.

Now the FUNding part. This process is where Payscape will deposit money into your bank account to compensate you for transactions processed. In order to fund you as quickly as possible, you should be aware of deadlines and holidays that impact the funding process.