Due to the coronavirus pandemic, air conditioning contractors have seen a boom in business. With an influx of people working from home, contractors are swamped with home renovations and repairs as well as improving air quality within residences. Merchant statements may not be at top of mind for most business owners during the pandemic, but Payroc can help your business have one less thing to worry about.

If you are an air conditioning contractor, then you know there is a cost associated with accepting credit card payments. You probably know the company processing your payments, you may remember the payments professional that set up your account and you hopefully know what your processing rate is. However, if you don’t know this information, there is a chance you are paying more than you should for credit card processing.

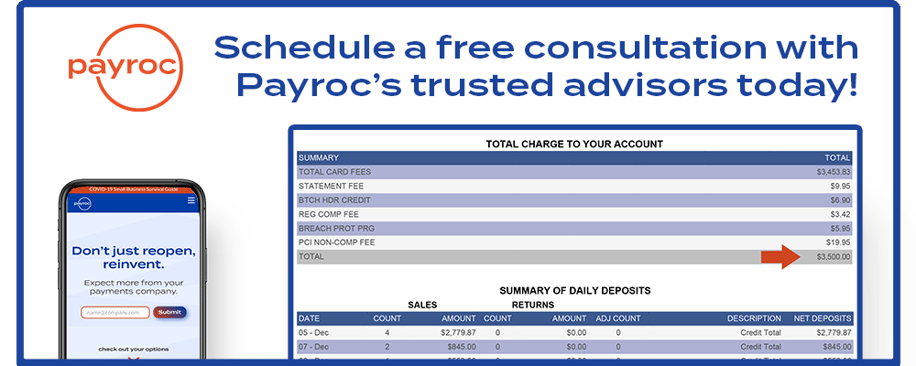

Let’s breakdown some of the fees and charges that may be showing up on your merchant statement every month:

Application & Setup Fees - Most companies will charge you an initial fee to set up your merchant account. This fee can be an upfront cost or a monthly cost spread out over the life of your contract.

Interchange Fees - These fees will make up the majority of your processing cost. There will be a percentage based fee based on volume and an additional per-transaction fee. These fees will vary based on a number of variables.

- Network - The network is the credit card provider associated with the payment. Visa, Mastercard, and Discovery are all very similar, with American Express typically being higher than the rest.

- Card Type - Fees usually vary based on the type of card being accepted. Debit cards, credit cards, credit rewards cards, etc. - All of these cards can be processed at different rates.

- Transaction Type - Typically, your rate is going to fluctuate based on the security of the transaction. A manually swiped transaction, with a pin code/zip code, and signature is going to be more secure than a hand keyed transaction accepted over the phone or internet. Therefore, the swiped transaction is going to be processed at a lower rate. Keep an eye out for Qualified and Non-Qualified transactions on your statement.

Other Fees - Assessment fees, monthly fees, equipment rental fees, etc. There is a number of other fees that may appear on your statement. It is important to identify these fees and to understand what your exact rates are.

How to Simplify Your Statement

It is always important to have fresh eyes on your statements. Whether it is your accountant/bookkeeper, your payments professional from your current provider, or even a payments professional from a new company you are considering switching to, it is important to have an expert review your merchant statement once a year. Ask your payments professional about Consolidated Billing. This simplified rate structure consolidates all of those fees into one flat rate that will not fluctuate based on any of the variables listed. Regardless of who you process with or what your rate structure is, it is imperative to understand your merchant statement.

Need some help understanding your merchant statement? Not a problem! My contact info is below - I've blocked off times specifically for consulting with ACCA Members. On average, working with Payroc saves our merchants 60-90% on their monthly processing fees. Get started today!

-1.png?width=171&name=Headshots%20(4)-1.png)