Three Strategies to Maximize Revenue on Micropayments

Posted on By Jacqueline Favara

This year’s National Automatic Merchandising Association (NAMA) show featured a session titled “Unattended Retail in Foodservice,” which focused on the growing consumer adoption of unattended retail solutions in sporting venues, hotels, travel hubs, healthcare facilities, universities, apartment buildings and beyond.

The data shows consumers prefer unattended retail because they can shop at their own pace and have control over their transactions. And that control increases their spending by 20% to 40%.

What does that mean for ISVs and merchants? Invest in unattended payments and autonomous shopping.

But when that business is in micro markets, pico markets, laundromats, vending, kiosks and other self-service solutions involving very low-dollar transactions, how can they keep costs down when customers control how many individual transactions they make?

For instance, one customer at a vending machine on campus could make 10 transactions at $1.50 each in a given day. In a traditional processing scenario, that would mean 10 times the typical single-transaction fee. Granted, interchange fees and fee plans vary considerably based on many factors. Still, the fees associated with processing 10 individual transactions from one customer will invariably cost more than a single combined transaction for that one customer.

To make sure you're processing microtransactions as efficiently as possible, you need a solution designed specifically for your business needs and a payment provider to bring it to fruition.

Micropayments Processing Has Come a Long Way

Not that long ago, the only option was processing each transaction individually. Each had its associated interchange and transaction fees, which added up quickly.

Then, an evolution: Enter technology and batch processing. Today, we can process as many transactions as possible and creatively work around those fees to save merchants thousands of dollars.

Look for a partner that's flexible and can support different transaction workflows that meet your unique business needs. Here are two common examples of transaction workflows we've helped ISVs implement for the most efficient and cost-effective microtransaction processing.

Common Option 1: Authorize-Capture-Reversal

One of the most common and simplest transaction flow to implement involves authorizing for a higher transaction amount, capturing a lower amount, and performing a partial reversal.

Take a modern workspace with a number of kiosks that dispense beverages, snacks, and freshly prepared foods throughout a building or campus.

Depending on your average transaction rate, a customer swipes, dips, or taps their credit card, selects an item for $2, and opens a door to retrieve that item.

Historically, this would involve a transaction per item. However, if the average total transaction rate per customer is $20, a higher transaction of $20 could be authorized. If the customer purchases only a $2 item, the system will authorize a refund or reversal for the $18 difference.

The employee is bound to repeat this behavior as they get peckish or thirsty throughout the day. These additional purchases could be handled through an amount adjustment and only the final amount will settle and appear on the cardholder's statement. 🍫

This transaction flow is much like the process of renting a car or checking into a hotel, where a larger authorization is made on a credit card and the actual charge is settled later when the car is returned or the guest checks out of the hotel.

Common Option 2: Tokenized Authorization

Another transaction flow that allows for better merchant tracking involves a similar process with the added functionality that comes from tokenization.

Tokenization involves replacing sensitive credit card data with a marker that represents that data as it’s exchanged across a network. The actual data is securely stored and shared only when the token is presented. And because the token has no real value, there’s nothing to steal if a fraudster happens to compromise a transaction.

This flow works well with micro-markets or laundromats, where microtransactions are extremely common and customers use the same payment method for multiple transactions. Using ISV-level authentication, merchants can track all transactions associated with a single credit card across multiple machines, combining them to reduce fees.

For example, the customer swipes or dips their card in the device attached to a specific washing machine. That swipe assigns a unique token that’s associated with the credit card. Let’s say the first transaction is for $5 or less.

The swipe essentially “opens a tab” with that token based on an average amount. Again, we can assume $20. (The owner of each location can change that amount based on customer behavior.) Each time the same card is used that day in that location (or even any location associated with that merchant ID), the transaction would increment the total amount toward the $20 authorization. Once the total hits $20, the process can either authorize another $20 or adjust the total.

The merchant would also identify a cut-off time, which signals when batch settlement would take place.

In summary, from the simplest to the most complex of transaction flows (with special features like offline mode or polling), the right payment partner can help you determine which transaction flow is best for your business and can help you take advantage of negotiated discounts for microtransactions.

Interchange Rates for Micropayments

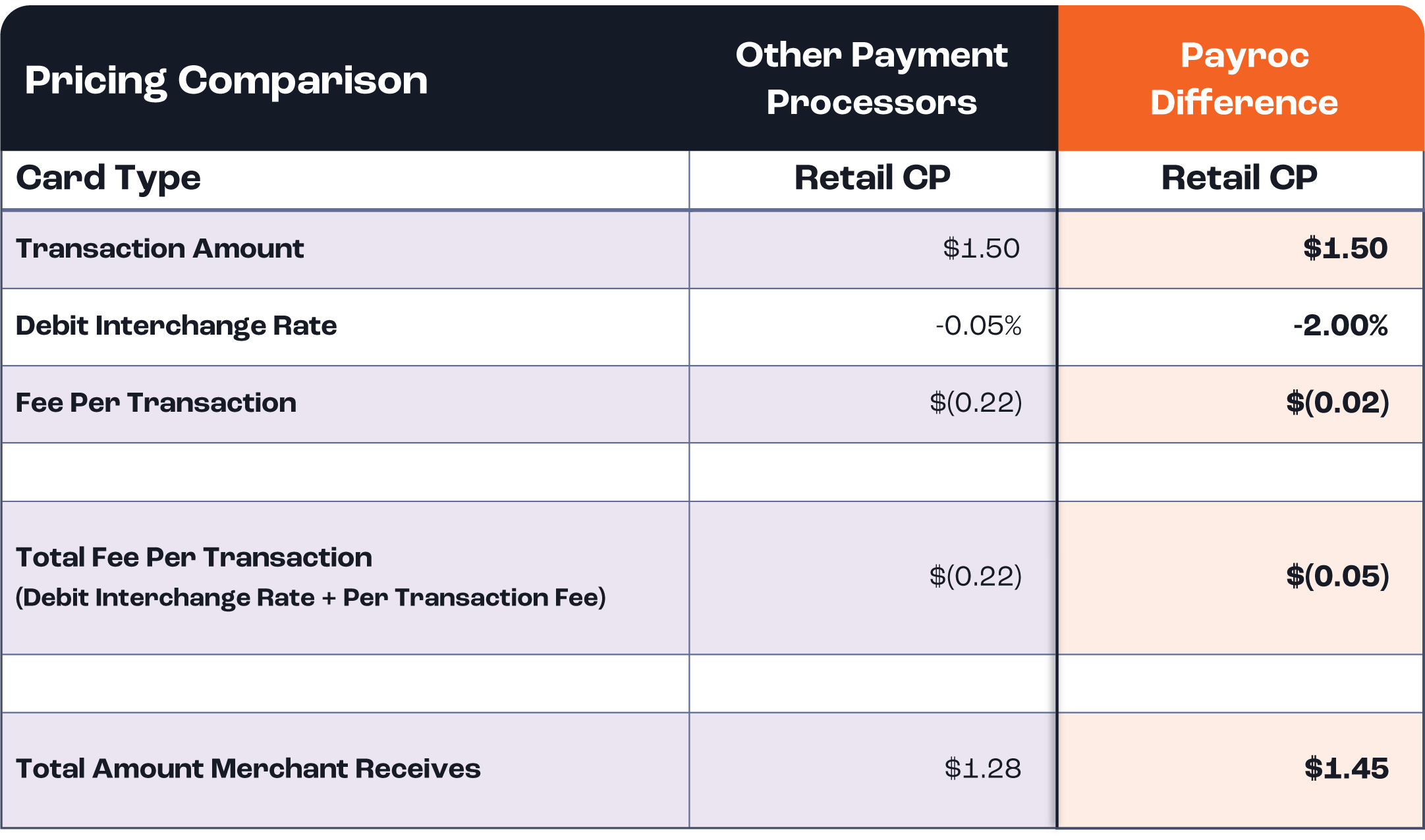

Payment processors like Payroc negotiate a special interchange rate per transaction with card brand companies (Visa and Mastercard only right now) to handle micropayments.

When we look at transactions as low as $1.50, the combined average saving for debit and credit cards combined is $0.17 per transaction.

What’s key for both flows is knowing your customer (KYC).

Knowing Your Customer Is More Important Than Ever

To make each of these transaction flows work best, you need to know your customers' behaviors and patterns, so they have the data needed to set up parameters for either flow.

Know customer data like:

- Average transaction cost

- Average number of transactions per day

- Frequency of transactions per location

- Timeframe of daily transactions (first to last)

In addition, merchants need to harness reporting capabilities to monitor transactions, transaction amounts, frequency, and timeframes.

By confirming averages and adjusting the process flow, merchants can better take advantage of processing fee savings. This is where customization becomes essential.

The Key to Success: Flexible Solutions

The more important factor to consider when looking for a payment provider to handle microtransactions and micropayments is finding one that can adapt to and solve each company’s unique business model and needs.

There are a host of solutions out there that require a merchant to invest their business and programming resources to process micropayments at a cost savings. The key is to work with a payment provider that does the discovery, identifies the best solution for each business model, customizes their API or performs programming, and requires little to no work from the ISV or merchant. That’s where the real cost savings happens.

At Payroc, our solutions are flexible and our team of solution experts will do the work to help build a solution that’s as unique as your business.

Let's review your payments strategy together because you deserve frictionless payments technology that’s designed to help you keep up and scale up in the modern digital economy.